With online payments becoming the norm for people for every other transaction, these are also becoming a convenient mode for education vertical. A key component required to accept online payments is the payment gateway. Elets News Network (ENN) speaks to key people in the payment gateway industry and finds out the relevance of payment gateways for educational institutions, innovative payment gateway systems, value-added services they are offering, how secure are these payment gateways and more.

Technology and IT are huge enablers today, potentially capable of covering and connecting all the people around the world. Therefore, online payments are becoming the norm for people as these are making life more convenient overall.

Technology and IT are huge enablers today, potentially capable of covering and connecting all the people around the world. Therefore, online payments are becoming the norm for people as these are making life more convenient overall.

The volume of online payments conducted has grown significantly since the introduction of the Internet-based transactions. Acceptance of online payments is also becoming a convenient mode for almost every trade vertical. With the large proliferation of internet in each and every part of India, online payments especially in Educational Sector, is seeing an upward trend. However, a key component required by an Educational Institute to accept online payments is the payment gateway.

While traditionally in India, the role of a payment gateway was restricted to only aggregation services, nowadays with online payments market being on an inflection point, the need of value-added services from large as well as small players have increased considerably. These value-added services are analytics, better success rates, faster processing, customised reports, large number of convenient modes of payments like accepting credit cards, debit cards, large number of net banking options, mobile payments, etc. A better Payment Gateway in the market capable of delivering these value-added services, and offering a secure system is crucial in the current times.

However, the challenges arise in incorporating the technology in a better way and streamlining processes to drive down costs, increasing product innovation and even more so with raising customer service levels through innovative strategies, mainly in terms of a secure surveillance and systems. Therefore, security is a vital component in terms of technological sharing even in payment systems. However, the questions linger: How corporate,offering payment gateway systems, ensure to have an optimum payment solution; What are the value-added services they are offering with the gateways; how relevant are the payment gateways for educational institutions; and, how secure are these payment gateways in order to maintain the privacy and security of the crucial financial transactions.

Parents can pay fees for their children without the hassle of standing in a queue to arrange for demand drafts or depositing cash at the cashier. On the other side, payment gateways are reducing the pain for educational institutions in collecting and managing the cash

Parents can pay fees for their children without the hassle of standing in a queue to arrange for demand drafts or depositing cash at the cashier. On the other side, payment gateways are reducing the pain for educational institutions in collecting and managing the cash

Catalysing the Financial Transactions

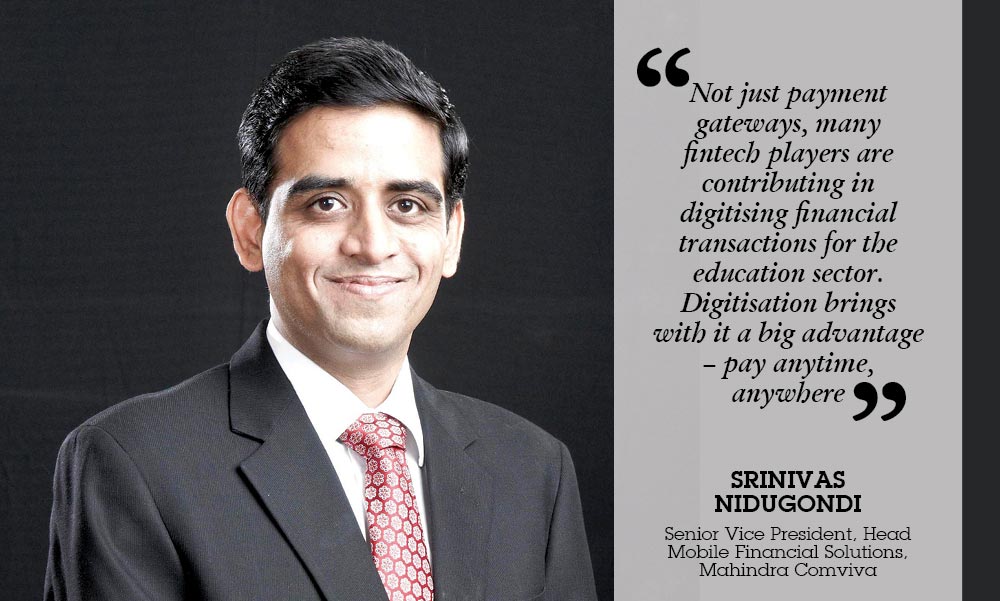

Online payments are widely accepted and becoming a convenient mode for compulsive spend verticals like Education. Payment Gateways are suitable for educational institutions who want to collect the fee and to do other financial transactions online. Srinivas Nidugondi, Senior Vice President & Head – Mobile Financial Solutions, Mahindra Comviva, said, “Not just payment gateways, many fintech players are contributing in digitising financial transactions for the education sector.

Digitisation brings with it a big advantage – pay anytime, anywhere. So far, schools typically had an associated bank and all school fee submission were done by filling up a form and submitting it along with a deposit slip at the bank. With a digital offering, schools can now enable parents to pay from the convenience of their home even on weekends or bank holidays. Additionally, value-added services such as reminders, standing instructions etc, provide tools which help in planning and timely payments.”

Not just payment gateways, many fintech players are contributing in digitising financial transactions for the education sector. Digitisation brings with it a big advantage – pay anytime, anywhere

Through payment gateways, educational institutes funds are easier to manage and can predict the settlement, mentioned Rahul Chiddarwar, Head – Payment Gateway Business, Direct Pay, at TimesofMoney. He said, “Right from selling the application forms to paying tuition fees and hostel charges, payment gateways act as a catalyst for financial transactions happening in educational institutions. Collection of entire amount can be done in a click. Fund allocations are also easier as institutes can predict the settlement. The transactions are transparent, convenient and it is easy to track and maintain records.”

Ashutosh Pande, Founder and Chief Innovation Officer, PaySe™, believes that the payment gateways are providing a convenient channel to parents and institutions for payments. He said, “Parents can pay fees for their children without the hassle of standing in a queue to arrange for demand drafts or depositing cash at the cashier. On the other side, payment gateways are reducing the pain for educational institutions in collecting and managing the cash. Though payment gateways have reduced the pain, but still the cost of cash is very high. Payment gateway charges somewhere between 2-5 per cent of transaction amount as fee.”

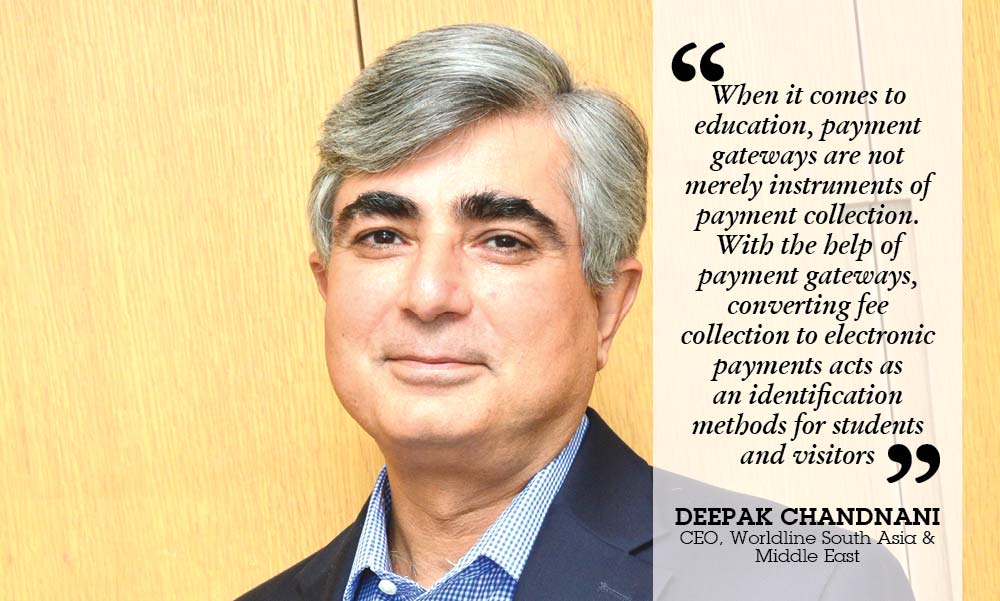

Education sector is catching up on adopting digital payments and converting from manual procedures to cashless, digital ones. Deepak Chandnani, CEO, Worldline South Asia and Middle East, said, “Higher education sector in India is expected to increase to $35.03 billion by 2025 from $6.96 billion in 2015 which will be accelerated by the growth in digital payments.

When it comes to education, payment gateways are not merely the instruments of payment collection. With the help of payment gateways, from converting fee collection to electronic payments acts as an identification methods for students and visitors. The university can provide access control in various areas of the campus and monitor cashless payments as well.”

“Worldline has recently tied up with Sharda University in Greater Noida, Rajarajeswari Medical College & Hospital, Bangalore and Emerald Heights International School, Indore to provide digital solutions for these institutions,” Chandnani added.

Innovative Solutions for Education Sector

With rapidly expanding market, unprecedented technological innovation and rapidly changing business environment, there is a need to build innovative payment solutions based on a solid architecture and a secure technical infrastructure, in compliance with the high demands of a complex payment system. To meet this demand, various organisations came up the payments gateways to ease the transactions process in education sector. Some of the innovative solutions are:

mobiquity® Money: Mahindra Comviva’s flagship mobile financial services platform mobiquity® Money is transforming the payments approach in education sector. It has been deployed by 67 mobile operators and banks in over 45 countries. Many mobile money providers use this platform to offer services for education sector such as pay school or university fee, pay examination fee, pay for books and stationery, send pocket money to children in boarding schools and take micro-loans for paying school fee.

DirecPay: DirecPay, of TimesofMoney, offers a gamut of services for education sector. They are:

- Special pricing for education sector;

- E-invoicing;

- Surcharge;

- Customised turnkey solution;

- Ability to integrate with institutes’ ERP solution;

Recurring fees.

PaySe™: PaySe™ (????) is the world’s first offline digital cash solution designed and created with an aim to democratise money. PaySe™ delivers the advantage of cash. It enables university/institution campuses to accept digital cash completely offline. Students will be able to use digital cash along multiple touch points – cafeteria, admin, peers, etc. Like cash, there is no need for reconciliation. PaySe™ solution consists of three key components:

- PaySe™ Processing Platform, is the interface between the real world and the digital world in accordance with the regulatory guidelines;

- PalmATM™ application converts a smartphone into a mobile ATM. This application provides the same access as a conventional ATM including the ability to withdraw and deposit;

- PURSE™ is a mobile to carry digital money and is designed to pay or receive digital cash. It empowers over 50 million families living without a mobile to bring the power of JAM (Jan Dhan, Aadhaar and Mobile) trinity to these and beyond to carry money. PURSE™ is just this mobile that securely stores the crypto token.

Worldline Payment Services: Worldline provides superior digital solutions for education institutions. It provides end-toend integrated payment services to handle the entire cashless payments in the college, including tuition fee, payments at canteens, shops etc.

The Added Advantage

With the role of payment gateways for simple financial transaction has increased considerably, there is a need of value-added services for better success. Srinivas Nidugondi provides a brief about the value-added services by Mahindra Comviva’s payment solutions. “For the enterprise, our product offers the flexibility of accepting payments from multiple sources and view all transactions that are made and payments due. For the consumers, it offers the option of setting up standing instructions for automated fee payment, reminders before due date etc,” he informed.

Briefing about DirecPay, Rahul Chiddarwar, said, “There are a lot of value-added services offered by DirectPay that include: On demand analysis; Multi bank EMI; Recapturing abandoned transactions; Stored card; and Freedom to choose the look and feel of website.”

Briefing about DirecPay, Rahul Chiddarwar, said, “There are a lot of value-added services offered by DirectPay that include: On demand analysis; Multi bank EMI; Recapturing abandoned transactions; Stored card; and Freedom to choose the look and feel of website.”

- On the value-added services provided by PaySe™, Ashutosh Pande informed that it offers the facility for:

- Connecting online world of e-money (banking through payment gateway) with the offline world of digital cash;

Enabling free peer-to-peer transactions (proximity payments) digitally like cash; - Enabling all activities (cafeteria, admin fees, event fees, fines, petty payments etc) of the institution to accept digital cash offline.

Worldline’s payment gateway solutions provide benefi ts to various parts of the value chain. Deepak Chandnani informed, “Customers get the fl exibility to pay from any mode – debit cards, credit cards and internet banking. For the bank and merchant, there is a detailed MIS so they get in-depth transaction information. Merchants can also use the power of analytics, analysing customer behaviour and patterns to aid sales strategies. Beyond this, the solutions can be coupled with a fraud and risk management module to monitor and combat fraudulent transactions.”

“Worldline also gives merchants a chance to develop omnichannel commerce for their business, by widening the scope of MIS and analytics, traditionally used for online transactions, to transactions at POS as well,” he added.

When it comes to education, payment gateways are not merely instruments of payment collection. With the help of payment gateways, converting fee collection to electronic payments acts as an identifi cation methods for students and visitors.

A secure payment gateway is crucial in the current times in order to maintain the privacy of the fi nancial transactions and to reduce fraud and increase consumer confi dence. Srinivas Nidugondi said, “Mahindra Comviva’s mobile fi nancial solutions make no compromises when it comes to security. We ensure that service and payment implementations are safeguarded with multi-level, bank-grade security in order to reduce fraud and increase consumer confi dence.

The security framework includes multi-factor authentication for access and transaction control, while all data is encrypted with the industry-standard 3DES algorithm. Our solutions adheres to international Anti-Money Laundering requirements and implement the best practices in PIN and Password management. Over and above this, the entire security approach is strengthened by Mahindra Comviva’s proven knowledge of country-specifi c regulations.”

Security is of prime importance to DirecPay while facilitating fi nancial transactions, informed Chiddarwar. He said that the company take care of the following security parameters:

- World class fraud management system;

- Real-time volume velocity checks;

- Rule based engine for monitoring and fl agging of perceived risk transactions;

- Double verifi cation checks for enhanced security for multiple forms of payment;

- Tracking of IPs and fl agging off transactions from high-risk countries;

- Dynamically updated global negative databases;

- Manual override tools for high risk transactions;

- Push and pull reports available across pay modes for better sanity.

Ensuring security is the most important part of fi nancial transaction processing. Deepak Chandnani, said, “As one of the biggest players in the acquiring space, we ensure security is the most important part of transaction processing. We have a robust fraud and risk management mechanism that analyses transactions in real time, assigns risk scores and fl ags off those with high risk. There is constant monitoring of all transactions processed and mapping against negative databases. Our solutions are PCI DSS compliant in order to provide the most secure services to our customers. Apart from this, we are certifi ed by ISO 9001:2008 Quality Management System and ISO 27001 Information Security Management System.”

eduPayment Solutions: The Way Ahead

The education sector is going digital. Today, one can purchase books online, access e-libraries, attend lectures virtually (distant learning via internet), do entire course online via webex or videos and even give the exams online. With digitisation of education the payments involved in it are also becoming digital. Digital payments include both online payments and mobile payments. Srinivas Nidugondi said that the digitisation of education, of which digital eduPayment is an important part, will transform the education sector in the following ways:

Expanding the Availability of Content: Education content such as books, journals, white papers are costly. Students cannot buy all of them. Moreover, students currently have access to mostly local study material and they are not able to study the global content. The few copies which are available in libraries have high demand and can be accessed by a limited number of students. Digitisation of education is changing this. Students will get global exposure as they will be able to buy books from international authors online. The libraries will become digital, which student will be able to access online and pay for the subscription of journals via digital medium as per their convenience. No longer there will be scarcity of books in libraries. Because of digitisation of content and digital payments, students will be able to just buy the required portion or relevant content and not the entire book.

Virtual Learning: Now the students are no longer restricted to by distance, lack of educational institutes or unavailability of courses. Virtual classrooms are making distant learning possible in an efficient manner. Students are able to attend lectures online and listen to guest lecturers from academicians across the globe and and learn skills by looking at videos. Not only this, students can give exams online and the checking of papers will also be done by computer system and result produced in a short time. For end-to-end virtual experience, payments will be made remotely by online or mobile, easing the transaction process.

Electronic Payment of Fees: Paying fees for school, university or applying for a course is time consuming, as students or their parents have to visit the educational institutes or nodal centers and stand in queues to make payments. The time and money spent in paying fee can be used more productively. With digital payments, cash based fee payments will be a passé. With online and mobile payments students will be able to pay at their convenience, remotely and in smaller installments. These types of payments are not only restricted to debit and credit card users, but the unbanked people using mobile money services such as Airtel Money, M-PESA, EcoCash, Orange Money and Mobicash are also able to make digital payments using feature phone.

Regarding eduPayments transforming educational landscape in times to come, Saloni Malhotra, Associate Vice President, Paytm, says, “India is undergoing rapid change and innovations across the board. As the education sector leverages the new digital tools available, a strong payment option is required to extend convenience. Our presence in 25000 institutions and impacting 10 million students positively by enabling single click payments shows the bright future of eduPAYMENTS.”

In coming years, payment will add more value as it is convenient, easy, safe and time saving process with transparency in place. Rahul Chiddarwar, said, “In spite of the digital trend, very few institutions accept online payments these days. But, looking at the payment preferences from students and parents, maximum institutions will start opting for online fees collection over a period of time. Obviously it will add more value as it is convenient, easy, safe and time saving process with transparency in place.”

Like any other sector, education also stands to gain from the growth in online payment solutions. Deepak Chandnani, said, “Currently, India has the world’s largest higher education system in the world with 762 universities. The government also plans to open more higher education institutes across India. Fee payments for education helps a university reach out to the parents as well, who are often the payment initiator.”

“With more services added onto the plain vanilla offering, a payment gateway helps the institution build a robust system that tracks and identifies student payments, maintains records, reduces mishandling of physical payments like cash and DDs etc. This improves efficiency and helps move towards digitisation of payments for education,” he added.

PaySe™ delivers the advantage of cash. It enables university/ institution campuses to accept digital cash completely offline. Students will be able to use digital cash along multiple touch points – cafeteria, admin, peers, etc.